After hearing about Beyond Meat’s latest news announcing a joint venture with Pizza Hut to make plant-based pepperoni, we at Simporter got hungry, ordered a few pizzas, and decided to analyze over 65,000 data points from the past two years that are about plant-based meat. Our dataset includes customer reviews of eCommerce products, social media mentions, and search interest growth from Google – driven by our AI software the automates new product research.

Tip Top

When initially diving into the data, we started by exploring overall consumer interest in plant-based meat. This helps us build a performance baseline across each channel, which we will then use to understand trends inside plant-based meat relative to category performance.

Initial analysis shows a highly interested disparity in plant-based meat consumer interest. Across customer reviews and social media data, consumer interest will grow significantly. Consumers are now leaving reviews twice as often as they did last year for plant-based meat products and posting on social media 80 percent more often than that same period. However, a sharp contrast, consumer search is on a downward slope with 10 percent less searches this year around plant-based meat than one year ago.

While we typically leave the potential “why’s” to consumer insights teams, three possible explanations come to the front of our minds for the gap between search interest and user-generated content.

- Search is predictive of trial but not recurring purchases. Plant-based meat was highly innovative a few years ago, with its peak in search activity hit in December 2019. As the category settles down, it is plausible that consumers are now more aware of the category, trial has already occurred for many plant-based meat consumers, and, as a result, they are less eager to search to understand its meaning.

- Search is predictive of longer-term demand and we will see a drop in user-generated content next year. It is possible that search predicts longer-term interest. When we dive into the data, we see around a six to twelve month delay between search spikes and user generated content spikes. As a result, we may see downward interest in plant-based meats in six to twelve months, following the downward search trend slope.

- Consumers aren’t eating plant-based meats as much as they say they do. Plant-based meat, in many social circles, is cool. It is supposedly environmentally friendly, healthier, and expensive. There is a scenario where consumers are increasing their posts and reviews about plant-based meats to “chase clout,” when really they’re consuming the products less often than they say they do.

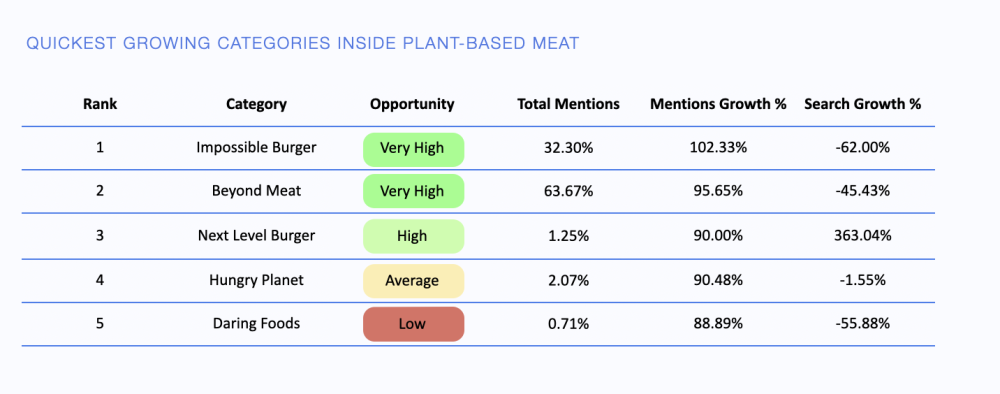

The Quickest Growing Plant-based Meat Brands

Impossible Burger and Beyond Meat are at the top of the pack by a distance in terms of their share of voice in the category, with the two brands making up around 97 percent of brand mentions in the space. In line with the category-wide drop in search, the two brands have search interest around 54 percent lower than last year when averaged together.

Across the remaining 3 percent of share of voice in the space, Next Level Burger leads with a High Opportunity Score assigned by our models, largely due to its steep growth in search interest – a fascinating contradiction to categorical decline. While Next Level Burger is primarily known as a burger joint, the brand is featured on premium shelves like Whole Foods and Lidl.

With roughly the same amount of mentions and growth in mentions across reviews and social media, Next Level Burger surpasses Hungry Planet’s predicted growth due to the roughly 365 percent disparity in search interest growth.

Finally, the last place brand in our analysis is Daring Foods. Daring has a very small amount of share of voice at just 0.71 percent of the category, as well as a steep drop in search interest around 56 percent. However, with its growth in mentions of 89 percent, there is a sense of optimism that the brand is still growing quickly. While our tool identifies Daring Foods as a low opportunity, we will keep an eye out in the future as we suspect it may advance into an Average Opportunity over the next twelve month.

The Quickest Growing Plant-based Meat Opportunities

Plant-based meat is traditionally viewed as where it first went viral — vegan burgers. But the category is so much more than that and, while burgers led initial awareness, they’re no longer among the top opportunities for brand to innovate within. When considering the wide range of different meats appearing in our diets, plant-based meat has a lot of untapped white spaces that brands can really focus on.

Plant-based fish is the largest opportunity for brands in 2022. Whether its fried fish like Long John Silver’s sells or fancy faux sushi, major players have largely overlooked spikes in consumer interest around plant-based alternatives to fish. Consumer search interest in the past 12 months is more than 20 percent higher than the year prior despite the overall category’s search interest decline of – 10 percent. Even more, consumers are mentioning it in reviews and social posts 4 times more often. That’s a significant leap and an area we highly recommend exploring further.

Behind fish, chicken nuggets are growing 337 percent in mentions and close to 10 percent in search interest, year-on-year. That means Impossible Foods’ and Beyond Meat’s recent nuggets launches are spot on. Consumers are actively searching for a version of plant-based meat that is convenient to eat on-the-go, can be cooked quickly, and has the potential to be a family favorite.

Bacon, while already a crowded space, continues to grow in consumer interest, which means there may still be room for new players. While consumer search is down 8 percent year-on-year for plant-based bacon, that is still 2 percent higher than category-wide consumer search interest for plant-based meat. So if plant-based meat brands are looking for a large area to expand within, they should focus on bacon, which has 8.49 percent share of voice in the category and, despite its large amount of conversation volume, continues to grow at an astounding 250% year-on-year rate in consumer mentions.

The plant-based meat category is large but just at its beginning stages. While consumers initially entered the category largely because of its sustainability benefits, brands have begun focusing on flavor and now we see a pivot in consumer interest to re-purchase due to taste. While search traffic across the category is down, it will be interesting to see how brands fight that and continue to increase trial of plant-based meat as we enter 2022 and beyond.

If you want to learn more about plant-based meat alternatives or how Simporter can find your next big product idea, sign up for a demo on our website.