Part I of the Beauty Mini-series: Cosmetics Trends That Will Define 2021

Men’s skincare is a burgeoning industry. Gone are the days when male grooming meant Palmolive shave cream from a tube, a Schick safety razor, and a splash of Aqua Velva. Especially among younger Millennials and older Gen Z males, skincare has become a fast-growing trend. Nearly twenty years ago, men who used skin exfoliators or moisturizers were dubbed mocked through a heteronormative orientation. However, today, that is no longer the case, as men begin to embrace skincare in the next major wave of cosmetics trends.

In this article, we compare the approach of two retail giants towards men: Sephora vs. Ulta Beauty.

Men Skincare: Selling Beauty in an Ugly Year

Store closures understandably hammered beauty retailers in the annus horribilis 2020. Ulta Beauty, the largest cosmetics retailer in the US, reported a 22% decline in revenue for the first nine months of 2020, dropping more than $1.1 billion from the same period in 2019.

Sephora, owned by LVMH, reported a 21% decline globally for the first nine months. Both retailers noted some positive momentum as they leaned into eCommerce and as consumers started venturing out more as the year progressed. But repairing the damage of 2020 is no instant fix, and beauty retailers need to pave new avenues for organic growth.

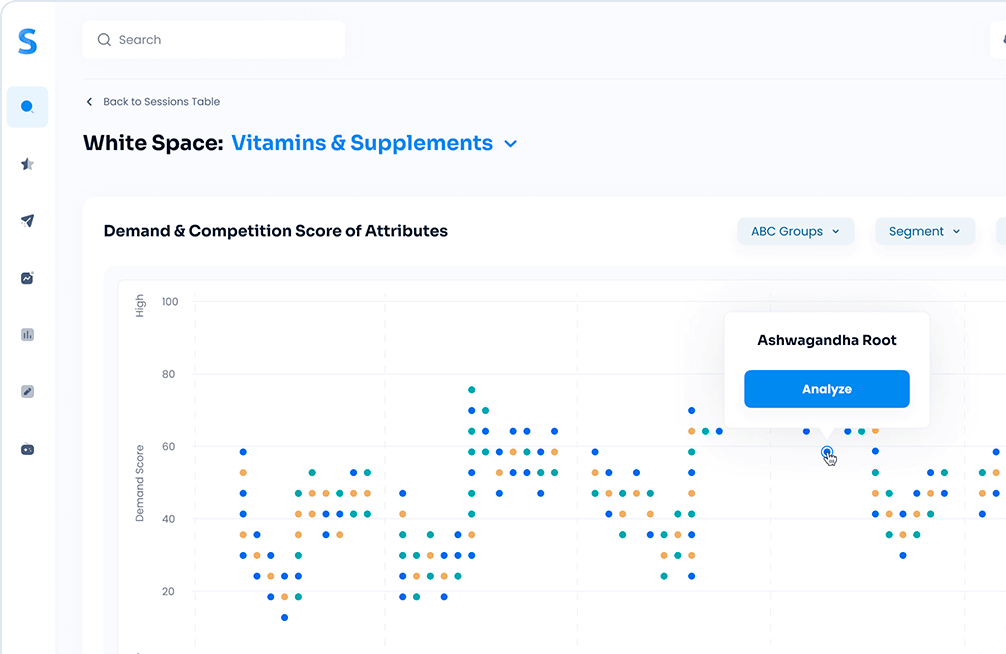

Historically, brick and mortar beauty chains and their imitators carved a niche by providing superb customer service, allowing consumers to try in stores and learn from expert beauty advisors. Vogue found customers were four times more likely to buy a product after interacting with or testing it. But even before Covid-19 there existed percolating concern about the sanitary conditions of makeup counters. Looking ahead, beauty retailers are going to need new approaches to rejuvenate top-line growth beyond hoping for more foot traffic and diversifying beyond the mall footprint. It’s incumbent upon them to find new consumer lanes, especially through eCommerce. Simporter’s research indicates one underserved market is premium skincare products designed uniquely for men. Simporter’s A.I. examined demand signals for Men’s skincare. They’re up and rising.

Analysis of search trends, social media postings, and eCommerce activity indicates

The growth of men skincare in the last year

Men’s skincare had a big 2020 and momentum will continue in 2021. Consumer search for the lexicon of keywords Simporter’s software collected — which encompass men’s skincare products, need-states, and benefits — grew +85% over 2020. Search correlates positively with the trial, so it’s an important leading indicator of demand. Our models predict this search rate will continue growing at a 21.7% compound annual rate in 2021 and beyond.

Natural Language Processing of social media postings also supports the growth of the skincare movement with younger guys. But it shows they have more questions than answers about what products would address their needs. Men’s overall grooming needs are currently being served by nimble startups in the premium segment and by big brands like P&G’s Old Spice and Unilever’s Axe in the mass segment. But when it comes to skincare specifically, the male market is a jump ball today.

Both Ulta and Sephora have a decent footprint of men’s’ grooming products including men skincare. But the differences lie in their tactics to serve the client. Unlike the smaller startups out there, their approach to educating the male consumer is pretty limited. We decided to present ourselves as a manly man on their platforms and see what we could learn about skin serums.

Putting Ulta Beauty to the test: why would a guy need a skin serum? And what exactly is it?

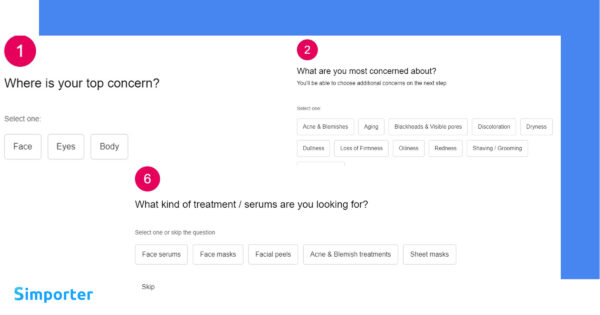

We searched all over Ulta Beauty’s site. The closest we came to answers was by taking a skincare quiz. To narrow down to a specific product range, the quiz led us through a brief series of questions shown in the upper part of the screenshot below.

After a few more questions, we got loaded to the last sixth question, which is shown on the lower part of the screenshot.

We picked “face” as our concern, then “aging” and “discoloration” in the next two questions.

Adopting the persona of a man who does not know what face serums do, we clicked on it and wound up with 36 choices of Skin Serum. But no clear idea what they are, or how and why men would use them.

Scrolling through the list, we noticed 34 of the choices were female-targeted, such as makeup remover. Buried in the list were two that appeared a bit more masculine — Jack Black face cleanser products, which are clearly male-targeted, and Kiehl’s, which felt solidly dual-gender. Only after selecting them and diving down into its product descriptions, did we learn some of the needs and benefits skin serum offers a guy. It takes a lot of work to get to an answer but at least there was some answer there.

Putting Sephora to the test: why would a guy need a skin serum? And what exactly is it?

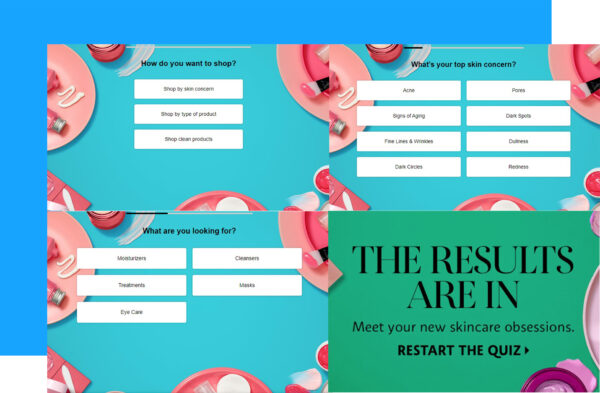

Once again, the only explanatory tool we found was a skincare quiz. We answered a series of questions identically as with Ulta Beauty. First, we selected skin as the concern.

Sephora only allowed us to choose one problem area. We selected “Signs of Aging.”

Next, we got to a question with vague responses required: “What are you looking for?” If we are a first-time shopper concerned about aging skin and dullness, how would we know which below to pick? For this test, we knew we wanted to get to skin serums and, after a little trial and error, we correctly selected “treatments.”

The highlights of the few more questions took us to a very non-male targeting pop-up. The highlights of our user journey are visible via the screenshot below:

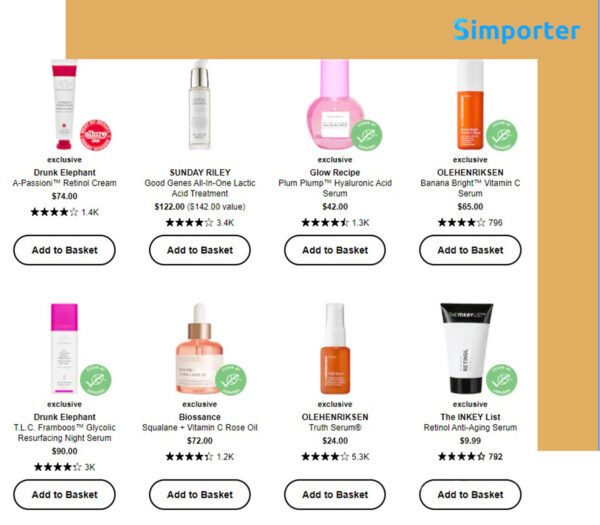

A couple more questions later brought us to this pretty, feminine pop-up featuring a list of exactly zero male-targeted serums. The overall view of the list is shown below:

With no men’s’ skin serums presented after the quiz, we really couldn’t figure out what they do. Sephora does offer these products for men, including the same Jack Black and Kiehl’s items found through Ulta Beauty’s site. It just takes more digging.

The winner — Ulta Beauty! (but not really).

While Ulta Beauty performed slightly better, neither site really passed muster on educating a guy on what a skin serum does and why he should use it. The businesses doing this effectively are niche startups that often sell on Shopify platforms and gain a following using Instagram and TikTok.

It’s axiomatic that for every woman, there’s a man.

Actually, demographics tell us that for every woman there are 1.02 men in the world, but that’s splitting hairs. Women’s skincare is an enormous market, while Men’s skincare is in the early stages where brand loyalty is not baked and product knowledge is quite limited. For marketers, converting either target audience poses significant challenges. But for brick and mortar retailers trying to generate more sales from eCommerce, the nascent male target audience is far too large a future opportunity to address half-heartedly.

In the next installment of our series, we’ll examine those young, upstart companies laser-focused on winning the male market for skincare.