Data is critical to making big decisions in your company’s R&D — are you paying attention to what the numbers are telling you? We wanted to dig into Sensory Attributes in Luxury Sun Care products to determine which will have the most challenging time remaining competitive in the crowded marketplace next year.

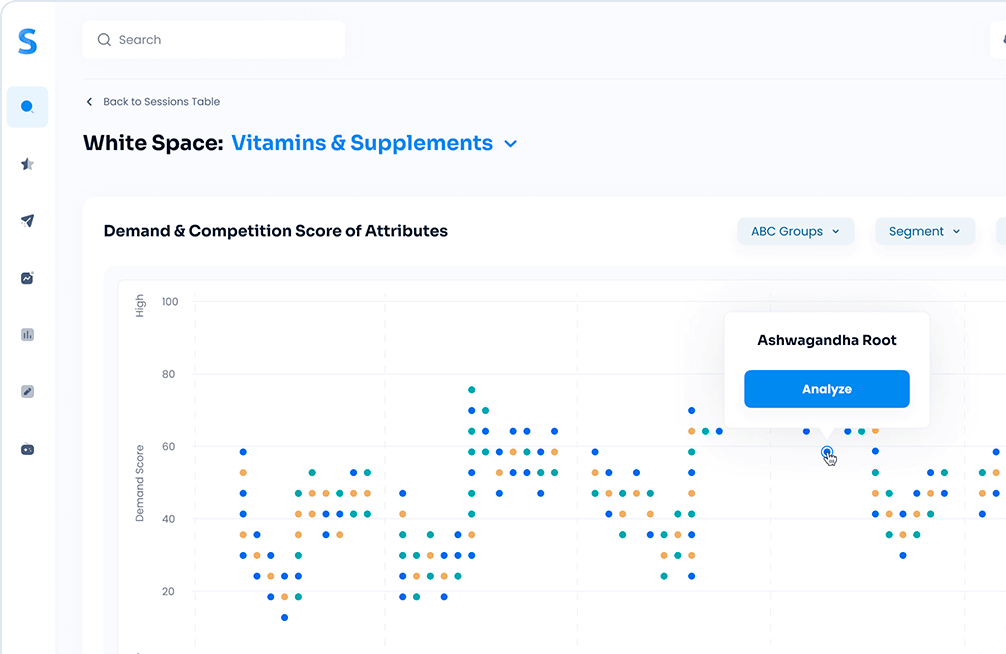

So, we used Our White Space AI tool to analyze 24 luxury sun care sensory attributes to forecast trends in 2022.

Get a Sense for the Numbers

The graphic below breaks down eight luxury Sun Care ingredients we believe possess the highest potential for growth in 2022. Sun care ingredient opportunity scores are determined by looking at both share of voice (a leading indicator of market share) and year-over-year growth rate.

Cooling

Cooling takes the top spot on our predicted loser’s list with a projected negative 75.41 percent growth rate for 2022. Even as we head into the first weeks of spring and summer, cooling effects and labels won’t be as popular as last year, despite having the largest share of voice on our list at 2.35 percent.

This makes sense, as we’re now squarely in the middle of winter and are heading into a few more months of cold. Consumers will want to stay away from products like La Roche-Posay’s Anthelios SPF 30 Cooling Water Lotion Sunscreen and focus on different sensory attributes instead.

Fragrance-Free

While Fragrance-Free has a much smaller share of voice (0.40 percent) than Cooling, our AI models predict a negative 87.83 percent growth outlook for this sensory attribute.

Consumers will prioritize the way their favorite sun care products feel than smell, so while Fragrance-Free may seem like a good option at first glance, we don’t recommend it. Focus on labels that will pique consumer interest like Full Coverage and Weightless to success in 2022, which we covered in greater detail in our recent blog about predicted Sun Care Sensory Attributes Winners.

Calming

Calming, similar to cooling, doesn’t have a tremendous growth outlook for 2022. With a negative 84.19 percent growth trajectory, Calming sun care products like this cream from Kiehl’s won’t be the most extraordinary items on the shelf this year. While Calming is a popular sensory attribute, holding a 0.88 percent share of voice, it doesn’t have as much weight as labels like Non-Comedogenic and Weightless, which will be trending in a positive direction instead.

Gelable

Consumers will be hyper-focused on the way sun care products feel in their search for the best barely-there product out there. Gelable (0.22 percent share of voice) textures won’t be trending in 2022 as consumers prefer smooth and creamy competitors. Don’t be surprised to see this sensory attribute decline 97.83 percent this year.

Grainy

Grainy is not a term many would use to describe the optimal texture of their sun care products, especially after sun care products — ouch! With a small 0.29 percent share of voice, Grainy products will be even less popular heading into the summer months.

The team here at Simporter predicts a negative 22.83 percent growth rate for products categorized as Grainy, so steer clear of this sensory attribute and focus on what’s trending instead.

Non-Greasy

Non-Greasy has a modest new year outlook, with a predicted negative 11.47 year-over-year growth rate. While this sensory attribute has a 1.65 percent share of voice, consumers will be focused on terms like Weightless and Oil-Free when looking for their next sun care product. Items like Hyrdropeptide’s Solar Defense Non-Tinted Broad Spectrum SPF 50 Sunscreen aren’t looking like they’ll perform well next year – so take notice and adjust accordingly.

Just Because it Worked in 2021, Doesn’t Mean it Will Again Next Year

It’s critical for luxury cosmetics brands to pay close attention to what the market data suggests will happen in the next 12 months. Consumers care deeply about how their Sun Care products make their skin and bodies feel, so if you haven’t already been adjusting your R&D methods to emphasize feel, now’s the time to do so.

Just because these sensory attributes performed reasonably well in 2021 doesn’t guarantee they’ll continue being popular moving forward. Stay on top of the upward and downward trends, and don’t get lost in the shuffle.

For more insights on luxury cosmetics trends, check out our recent webinar here. If you’re ready to see Simporter AI in action and learn what it can do for you, request a demo on our website.